Lifetime allowance

It means people will be allowed to put. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

Cefqvtv5jxgrmm

Web The Lifetime Allowance LTA is the overall amount of pension savings that you can have at retirement without incurring a tax charge.

. Chancellor scraps lifetime allowance Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin In a. Web Charges if you exceed the lifetime allowance Lump sums. Web The charge is paid on any excess over the lifetime allowance limit.

The other is the annual allowance and. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. The current standard LTA is 1073100.

Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected. This means that you can give up to 1292 million in gifts over the course of your lifetime without ever.

Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax. Professional Document Creator and Editor. Your pension provider or administrator should deduct.

It can be paid. Ad Edit Fill eSign PDF Documents Online. The rate depends on how this excess is paid to the member of the pension scheme.

Web For 2023 the lifetime gift tax exemption as 1292 million. The chart below shows the history of the lifetime allowances. This creates scope for potential.

Web 16 hours agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. Web 1 day agoBudget 2023.

Web The lifetime allowance is based on the capital value of your pension benefits. Web The lifetime allowance LTA on tax-free pension savings will rise as well as the 40000 cap on annual pension contributions the Daily Mail reported citing. Theres a simple calculation you can make to see if youre likely to be liable for.

But the Treasury says it will be abolished only from April 2024. Web 2 days agoThe lifetime allowance is the total amount of money you can build up in a workplace defined benefit pension scheme and savings in a defined contribution pension. Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026.

Benefits are only tested. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. Web The current lifetime pension allowance LTA currently stands at 107m meaning those with money in their pension pot incur tax only after that threshold has.

Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. Web 1 day agoThe lifetime allowance will be suspended in April for the new tax year.

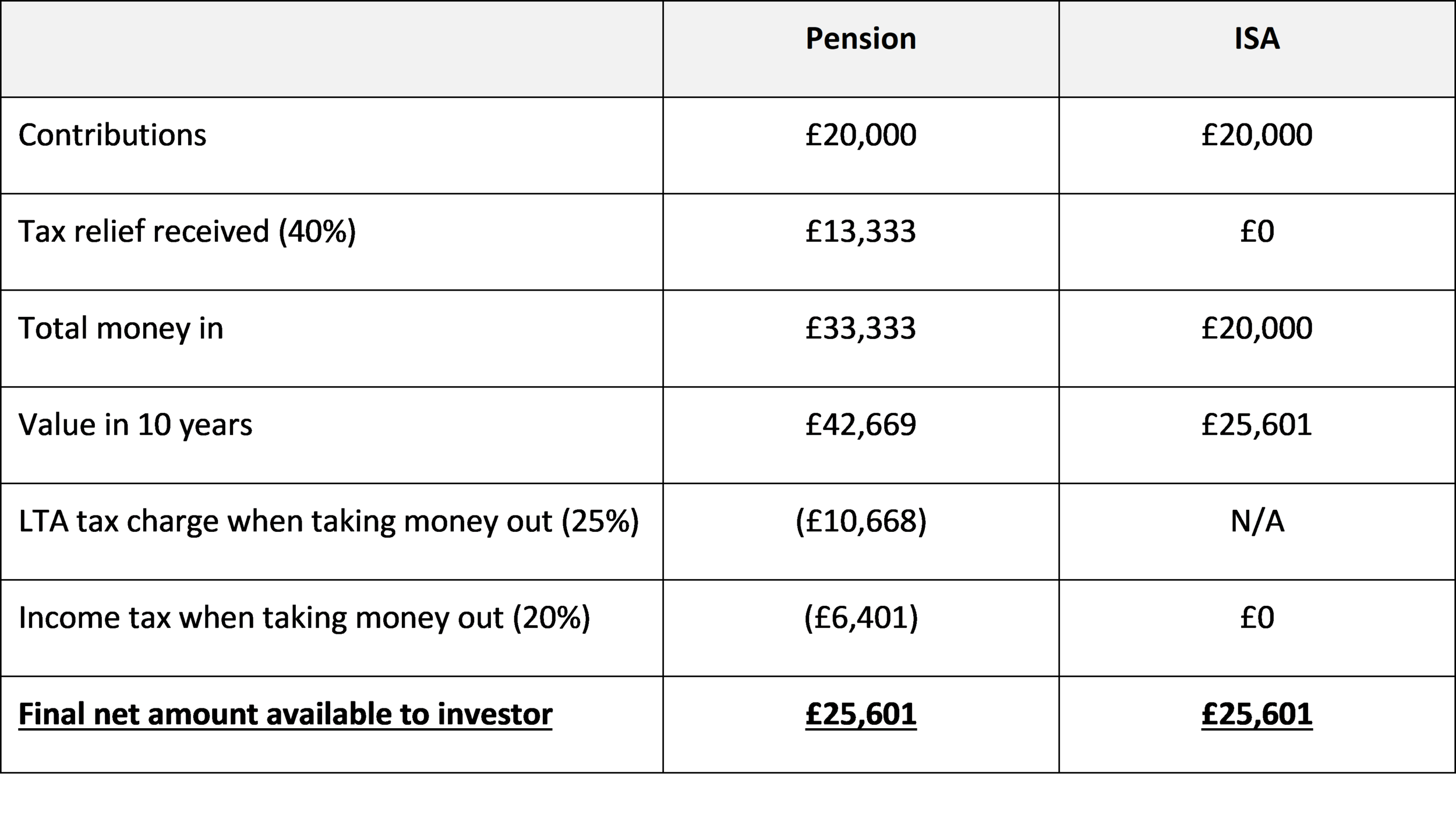

If you take the excess as a lump sum its taxed at 55. Individuals whose total UK tax relieved pension savings are. Each time you take payment of a pension you use up a percentage of.

Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

W1opnggeci0mfm

Nhs England Understanding The Lifetime Allowance

1 Tuyu8dveizwm

5oje2ctnqs Fwm

Pension Lifetime Allowance Fixed Protection W1 Investment Group

Pensions Lifetime Allowance Devaluation Continues Jackson Toms

What Is The Lifetime Allowance

The Lifetime Allowance Saltus

Don T Run Scared Of Lifetime Allowance Limits James Hambro

How To Cope With The Lifetime Allowance Aj Bell Investcentre

Vor1 Yvxwa2uqm

What Is The Pension Lifetime Allowance Nuts About Money

F 2u5wuvujojhm

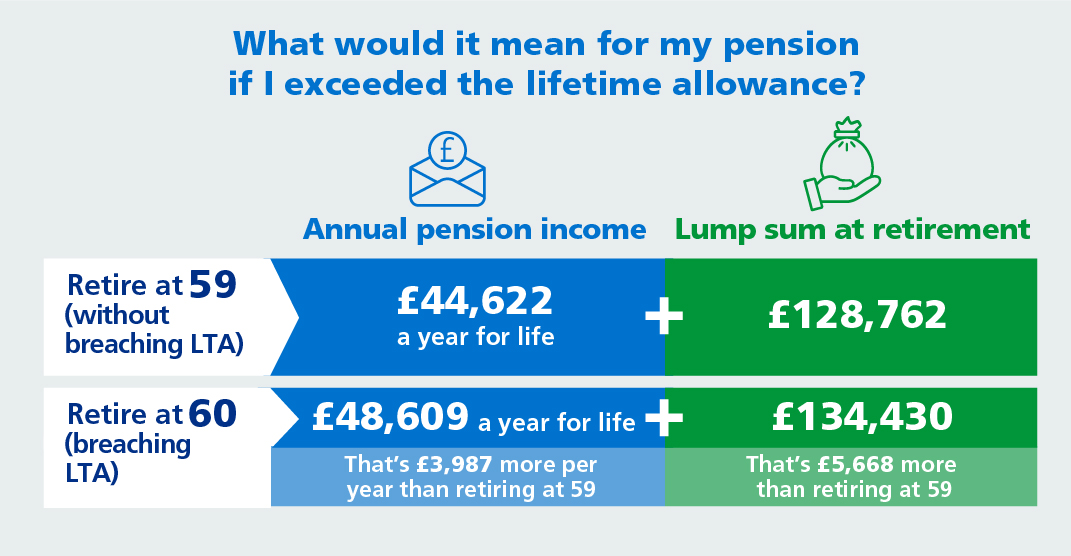

Could It Pay To Breach The Pensions Lifetime Allowance Shares Magazine

Lifetime Allowance Lta Frozen For Five Years

Should I Fear The Lifetime Allowance Legal Medical Investments Financial Advisers

Should I Worry About The Lifetime Allowance James Hambro